Perspectives

Lessons from Medicare Part D’s Donut Hole

A Case for Intelligent Consumerism in Oxbridge Health’s Episode Benefit Plans

Executive Summary

The Medicare Part D “donut hole” provision was originally implemented as a cost containment mechanism, shifting part of the financial responsibility for prescription drugs to the consumer once a certain spending threshold was reached. This feature created a powerful economic incentive for Medicare beneficiaries to seek lower-cost drug alternatives or reduce unnecessary prescriptions.

Oxbridge Health draws inspiration from this behavioral dynamic in its Episode Benefit Plans, incorporating a similar “donut hole” above a guaranteed allowance for episodic care. When paired with Episode Advantage’s unique shared savings incentive for purchasing below the allowance, Oxbridge re-engineers the consumer experience in healthcare to align with rational, value-driven decision-making—delivering smarter choices, lower costs, and improved financial predictability.

The Medicare Part D Donut Hole: Design and Intent

Medicare Part D, introduced in 2006, created a prescription drug benefit with distinct phases:

- Deductible Phase

- Initial Coverage Phase

- Coverage Gap (Donut Hole)

- Catastrophic Coverage

The donut hole began when a beneficiary’s total drug costs exceeded an initial coverage limit and ended once their out-of-pocket spending reached the catastrophic threshold. During this gap, beneficiaries were responsible for a significantly higher portion of drug costs.

Intended Goals:

- Encourage price-sensitive behavior.

- Limit federal liabilities.

- Promote market discipline in drug pricing.

Observed Impacts:

- Consumer Behavior: Beneficiaries became more cost-conscious, often switching to generics or halting non-essential medications.

- Market Response: Increased demand for cost-effective drugs and price competition among pharmaceutical companies.

- Policy Evolution: Over time, bipartisan legislation gradually closed the donut hole, but its behavioral legacy remained influential.

Behavioral Economics of the Donut Hole

The donut hole functioned as a behavioral “shock zone”—where consumers were briefly exposed to real prices. Key outcomes:

- Elasticity of Demand: Studies showed a measurable drop in prescription utilization during the coverage gap—especially for non-essential or high-cost drugs.

- Price Sensitivity: The gap incentivized beneficiaries to compare prices, often using drug price comparison tools.

- Risk Mitigation Behavior: Some beneficiaries began front-loading essential medications early in the year or using generics strategically.

This experiment in consumer-directed cost exposure yielded insights now adopted in innovative benefit design strategies beyond pharmacy benefits.

Oxbridge Health’s Donut Hole for Care: A Modern Reapplication

Oxbridge Health’s Episode Benefit Plans are powered by Episode Advantage, a consumer-centric model that redefines how patients shop for care. One of its distinguishing features is a modern reinterpretation of the donut hole concept.

Structure of the Oxbridge Donut Hole:

- Each episode of care has a guaranteed allowance—based on market-cleared, bundled pricing.

- If a member selects a provider whose episode cost is below the allowance, they:

- Receive the care at no additional cost.

- Share in the savings through the Oxbridge Benefit Bank.

- If a member chooses care above the allowance, they pay the difference—entering the “donut hole” of cost exposure.

Implications:

- Encourages rational decision-making.

- Preserves freedom of provider choice.

- Avoids unnecessary overutilization of expensive options.

- Drives consumer engagement without coercion.

Synergy of Donut Hole + Shared Savings: Behavioral Impact

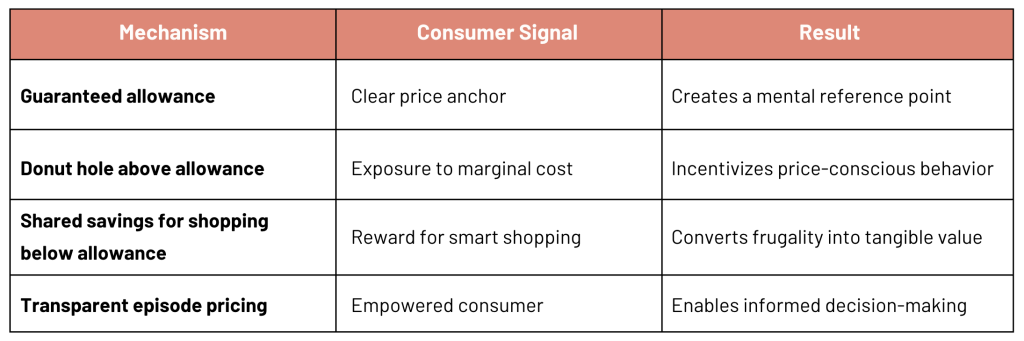

The unique integration of the donut hole model with shared savings distinguishes Oxbridge Health. Here’s how the combination works behaviorally:

Consumers don’t just avoid penalties—they’re rewarded for value-seeking behavior. This transforms passive plan members into active healthcare shoppers.

Evidence-Based Expectations for Consumer Behavior

Drawing from the Medicare Part D experience and early Oxbridge pilot implementations, we anticipate:

- Higher Episode Selection Rates Below Allowance: Comparable to increased generic drug usage during the Part D donut hole.

- Improved Financial Predictability for Consumers: The known maximum out-of-pocket structure resembles the “catastrophic cap” in Medicare Part D.

- Downward Pressure on Episode Prices: As more consumers gravitate toward better-value providers, high-cost providers must compete or adapt.

- Increased Utilization of Episode Advantage Tools: Including provider comparison dashboards, outcome-based ranking, and real-time price alerts.

Policy and Market Implications

The Medicare donut hole experience proves that exposing consumers to price signals can change behavior without harming quality—particularly when paired with transparency and incentives.

Oxbridge’s model builds on that legacy:

- Private-sector application of proven federal policy mechanics.

- Modernized for bundled care, not just pharmacy.

- Aligned with fiduciary best practices for employers.

This benefit design also equips Oxbridge’s partners—employers, TPAs, carriers—with a powerful engagement and cost-control lever that’s simple to administer and psychologically compelling.

Conclusion

The Medicare Part D donut hole revealed the latent power of consumer cost exposure to influence purchasing behavior. Oxbridge Health advances this concept for a new generation of healthcare consumers—not by penalizing choice, but by rewarding value and creating meaningful consumer control.

By strategically combining the behavioral economics of the donut hole with the shared savings model of Episode Advantage, Oxbridge introduces a 21st-century benefit design that is:

- Transparent

- Equitable

- Efficient

- Empowering

The result is smarter spending, better outcomes, and a healthcare marketplace finally responsive to the people who fund it: the employers and employees.