Perspectives

Unleashing Healthcare’s Most Underutilized Asset: The Consumer

The Power of Agency, the Failure of the Status Quo, and the Bold Path Forward with Oxbridge Health

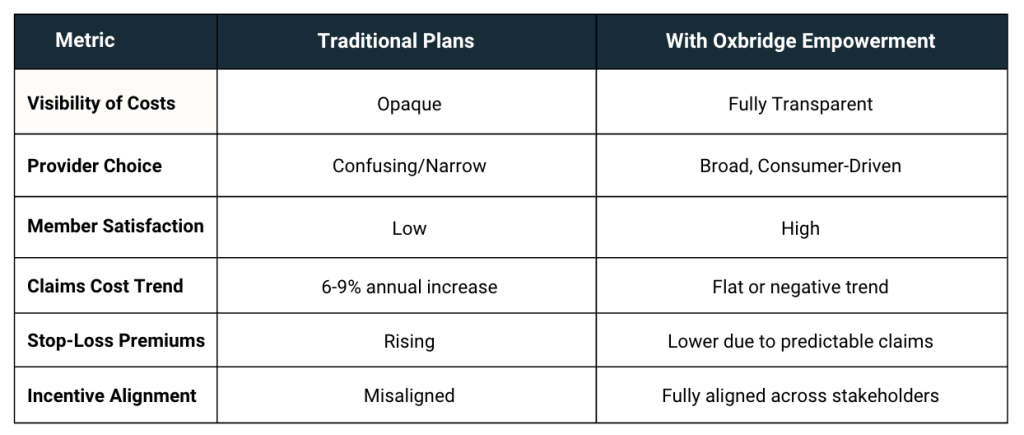

Despite spending nearly $4.5 trillion annually on healthcare, America has yet to tap into its most powerful resource for reducing costs and improving outcomes: the consumer. Decades of employer-sponsored insurance models, opaque pricing, misaligned incentives, and paternalistic benefit designs have rendered the average healthcare consumer passive, confused, and disengaged.

This white paper argues that restoring agency to consumers—giving them visibility, choice, and a stake in their healthcare decisions—is not only possible, it is essential. It is the missing link in unlocking systemwide efficiency, satisfaction, and trust. The transformation of other industries—from travel to telecom to finance—has proven that when individuals are empowered with clear prices, informed choices, and personal incentives, entire markets shift.

Oxbridge Health represents the boldest, most complete expression of this truth in the healthcare landscape. By combining guaranteed episode-based pricing, behavioral economics, and innovative benefit design, Oxbridge enables consumers to become the very lever by which employers and the healthcare system reduce cost, improve satisfaction, and restore fairness.

The Consumer, Ignored and Underused

The Illusion of Choice in Traditional Plans

Consumers in traditional PPOs or HMO structures are told they have “freedom,” but in practice, they shop in a pitch-black room:

- No prices up front.

- No understanding of value.

- No ability to financially benefit from smarter choices.

This is not a design flaw—it’s the design itself.

The Result?

- Overutilization of high-cost, low-value care.

- Frustration with surprise bills and narrow networks.

- No meaningful ability to control out-of-pocket costs.

- Passive behavior that leads to runaway spending.

When Consumers Have Agency: A Tale of Other Industries

Travel: The Explosion of Online Booking

Before Expedia, Priceline, and Google Flights, you needed a travel agent to “manage” your trip. Prices were hidden. Choices were limited. The introduction of transparency and comparison shopping turned consumers into savvy travel agents, and airline margins dropped dramatically while consumer satisfaction soared.

Wireless Plans: From Bundles to BYOD

Consumers now choose their carrier, their plan, and often even bring their own device. Plans became simpler, prices dropped, and the balance of power shifted from the carriers to the user.

Finance: From Bankers to Robinhood

Trading stocks used to require brokers. Now, consumers make their own trades in real time, with no fees and full transparency. Empowerment reshaped behavior—and markets.

The Unrealized Potential in Healthcare

Imagine if:

- A knee replacement cost $22,000 in one setting and $65,000 in another—and you got to see that.

- You could earn money back for choosing the more efficient provider.

- You could use those savings for future care—or even donate to a colleague in need.

- You could choose your provider based on outcomes, cost, and your values—not just insurance network constraints.

This isn’t a fantasy. It’s what the Oxbridge model enables.

Three Pathways to Empowering the Consumer

Visibility: Show the Price. Show the Value.

No more guessing. With Oxbridge, every episode of care (from maternity to orthopedics to cardiology) comes with:

- A guaranteed price.

- A clear set of what’s included.

- An apples-to-apples comparison across providers.

Agency: Let Them Choose—and Win When They Do

Consumers don’t need to be forced into narrow networks. They need to be rewarded for value. Oxbridge’s benefit design allows them to:

- Choose any provider (Episode Advantage or PPO).

- Shop against a generous allowance.

- Keep the savings when they spend less.

Alignment: Give Them Skin in the Game

Through the Oxbridge Benefit Bank, employees earn credits for smart decisions:

- Spend less than the allowance? You keep the difference.

- Accumulate credits? Use them for future care, family members, or even to help coworkers in need.

- Suddenly, cost-consciousness becomes a shared goal, not an imposed burden.

The Systemwide Impact of Consumer Empowerment

Projected Impact per $100,000 in Claims

- Up to $15,000 in savings through guaranteed episode pricing

- $3,000–$5,000 in shared savings behavior

- 20–30% lower specific stop-loss premium due to reduced volatility

- Reduced aggregate corridor costs through lower trend

Why Oxbridge Health Is the Most Powerful Expression of Consumer Empowerment

Oxbridge is not another managed care layer. It’s managed competition done right. It restores choice with consequences, visibility with value, and freedom with fairness.

Built on Three Pillars:

- Episodes of Care: Fixed prices for high-cost conditions. No surprises. Guaranteed outcomes.

- Behavioral Economics: Consumers respond to incentives when they’re real and tangible.

- Innovative Benefit Design: Allowances, shared savings, and non-covered corridors create real choices—and real alignment.

Bold Prediction: The Tipping Point Is Near

As employers face unsustainable cost growth, ineffective point solutions, and employee frustration, they’re ready for something new—but real. Oxbridge is that solution.

- The next decade in healthcare will not be defined by AI or digital tools alone.

- It will be defined by whether the consumer is finally treated as a stakeholder.

If we unleash them, we change everything.

Conclusion

We’ve spent decades designing healthcare for the consumer but never with them. That ends now. The solution isn’t more control. It’s more freedom—with responsibility, information, and reward.

Oxbridge Health is the model. The moment is now. The consumer is ready. Are we?